Author: Richard Branson

Pest Control – Bed Bug Extermination

Pest Control – Bed Bug Extermination

The “pest of the 21st century” is what urban entomologist Michael Potter calls the tiny, blood-sucking pests that are spreading panic across the country. A leading expert on the habits and resurgence of Cimex lectularius, the common bed bug, the University of Kentucky researcher has found that modern bed bugs are increasingly resistant to pyrethroid insecticides commonly used to control them. Even worse, bed bugs are passing this resistance onto their offspring. Already a problem for apartment owners and property managers, a super bed bug is not a welcome thought, particularly with pending state legislation and new municipal regulations getting ready to place the onus for dealing with these problem pests at landlords’ doorsteps.

Bed bugs have been sharing beds with humans for centuries. After World War II, DDT effectively annihilated the pest in America and Western countries, although bed bugs continued to flourish in less developed countries. The banning of DDT coupled with the growth of international travel has caused a resurgence of man’s age-old nemesis. Since the 1990s, reported bed bug infestations in the U.S. have increased by 500%. Bed bugs are now common in all 50 states with infestations regularly reported in apartments, condominiums, hotels, college dormitories, office buildings, hospitals and private homes.

Adept hitchhikers, bed bugs travel into apartments on residents’ clothing, mattresses, furniture, and inside packing boxes. Several recent infestations have been traced back to moving vans. Adult bed bugs are reddish-brown and about the size of an apple seed, but nymphs and eggs are microscopic. Nuisance pests that feed on human blood, bed bugs do not transmit disease; but their bites can cause itchy, red welts, psychosomatic stress, and severe allergic reactions. Feeding on sleeping humans at night, they hide in tiny crevices in or near beds between feedings. As an infestation grows, bed bugs spread to adjacent units through wall voids, electrical and plumbing conduits and air ducts. Bed bugs can easily be spread through an apartment complex via shared laundry facilities or maintenance workers.

Legally tasked with providing pest control services for tenants, apartment owners are being now faced with losing the litigation war on bed bug treatment as well. With new pending legislation, apartment owners may soon have to bear the responsibility and financial expense of providing housing that is rat, roach and soon to be bed bug-free. While other vermin can be eliminated with proper maintenance and control costs recouped in rent payments, bed bugs are an entirely different problem. Insects of convenience, they are not attracted by food or filth but are brought into apartments by residents. They are as likely to be found in upscale, well-maintained establishments as in tenements.

To date, efforts to combat bed bugs have focused on reactive measures focused on treating the problem after the fact. Cutting-edge technologies at both ends of the temperature spectrum are being used to control insecticide-resistant bugs. New bed bug monitoring and trapping products just coming onto the pest control market offer the first opportunity for proactive prevention. A game-changer in the fight against bed bugs, bed bug monitors are the first 24/7 preventative tool available on the market. Not only could proactive use of bed bug monitors become a powerful tool in protecting property and tenants, but they could turn the tide in the courtroom. In defending against bed bug litigation, regular monitor use could positively influence judges and juries in favor of apartment owners.

Monitors have the potential to alert property managers to bed bugs in the early stages of infestation while they are confined to the bed and bedroom. Early detection can allow property owners to arrange professional extermination of an affected apartment before pests spread. If bed bugs are discovered, monitors can determine the effectiveness of treatment and warn of re-infection. Monitoring adjacent apartments can alert property managers to spreading bed bugs, allowing targeted pest control. Early detection and intervention could save apartment owners thousands of dollars in professional pest control costs.

As with any new field, innovative pest control professionals are experimenting with various bed bug monitoring products in the field to determine which are most effective in different situations. U.S. tests and European use indicate that proactive use of bed bug monitors has the potential to turn the tide in the bed bug battle. Some of the potentially game-changing products being introduced include:

Our company uses heat and pheromone lures to attract and trap bed bugs, killing them with carbon dioxide.

Bug Dome, developed by Silvandersson, an eco-friendly Swedish manufacturer, plugs into any wall outlet, using heat to lure bed bugs into replaceable glue traps.

BB Alert Active from MIDMOS, popular in Europe, uses replaceable packets of a blood-mimicking chemical attractant to entice bed bugs into a glue trap.

CDC 3000 by Cimex Science is a discrete, portable, electric monitoring and trapping device the size of a briefcase. Mimicking the presence of a human body, it lures bugs within a six-foot radius, trapping them on sealed slides for counting and documentation, annihilating them with carbon dioxide. Safe for use around children and pets, it can be moved from room to room.

Climbup Insect Interceptor by Susan McKnight Inc. is an inexpensive, low-tech device that is placed under bedposts to monitor bed bug presence. Concentric plastic rings coated with slippery talc trap bugs as they climb toward or from a bed.

Bed bug dogs are specially trained to sniff out bed bugs. Capable of detecting pests within a three-foot radius, dogs quickly target treatment areas or verify treatment success.

Bed bug monitoring can protect apartment owners from lawsuits, reassure tenants, maintain property values and uphold reputations by enabling owners to certify their properties as bed bug-free. If bed bugs are discovered, bed bug monitors can minimize their spread and extermination expense. In the near future, regular use of bed bug monitors by purchase, rental, or contracted services is expected to become a routine part of apartment maintenance. Bed bug monitors give apartment owners and property managers their first real 24/7 proactive weapon in the growing battle against bed bugs.

The Financial Side of an RV Purchase

The Financial Side of an RV Purchase

In a perfect world, we all would be able to just walk into an RV dealership, pick out the one we like, write a check for the purchase, and drive away. Of course, for most people, that isn’t how it works. Even the cost of RV’s today, most people will need to finance the purchase of the RV so they can pay it off over a period of time. While having to get a loan for your RV purchase might complicate the process a little bit, it shouldn’t be too difficult to manage. As long as you have reasonable credit and enough income to qualify for the loan, most dealers or banks will be happy to work with you.

Before you ever step foot on an RV lot to look at the possible rigs you could purchase, you should have a very clear budget in mind. It might help to stop by your bank and ask about RV loans in regard to what terms they can offer, and what amount you could qualify for. This will give you a starting point for your budget, and also help you to determine what your monthly payments would look like based on the cost of the RV that you end up purchasing. Armed with this information, you can start to visit some dealers and work on finding the RV that is right for you and your family.

You’ve Probably Done This Before

Even if this is your first RV purchase, you likely have already bought a car at some point in your life. If so, the RV buying process will probably look pretty familiar. The process of getting a loan to buy an RV is very similar to that of getting a car loan, and you might even be able to work with the same lender. You will have the option of putting down as much of a down payment as you would like, although you probably don’t have a trade-in like you may have when you purchased a new vehicle. Obviously, the more down payment you are able to put on the purchase, the smaller the loan you will need to take out. The lender will want to do a credit check, and will offer you terms for the loan based on a number of factors, including the size of the purchase and your credit history.

Understand the Monthly Payment Obligation

While it is important to understand all of the terms of your RV loan, the monthly payment number is one to pay particular attention to. If you aren’t comfortable with paying back that amount each month, you shouldn’t take on the loan. Go into the process with a firm limit on how much you are willing to take on per month, and don’t exceed that number. The RV you are buying should be a source of fun and excitement in your life – but it will be more stressful than anything else if the loan payment becomes a significant burden.

Keep an Eye on Refinancing

After you secure an RV loan and make a purchase, keep checking in on the average lending rates from time to time. If they fall significantly from the time of your original purchase and are below the terms on your current loan, you might be able to refinance the loan and save yourself money in the process. Of course, there are usually fees associated with a refinance, so make sure that the overall financial picture of refinancing the loan comes out in your best interest. However, if it does make sense for you, it can certainly be worth your time to save money both on a monthly basis, and in terms of interest over the life of the loan.

Being prepared before you head into an RV buying process is the most important lesson that you can learn. Know what kind of budget you have to work with, and what amount of monthly payment you are willing to take on. This will give you clear and defined targets and will help you to not get talked into something you can’t afford by the salesperson. At the end of the day, the goal is to drive away with an RV that is perfect for you and your family, for a price that you are comfortable with.

This Blog was posted by Coastal breeze RV Resort in Rockport Texas

Electrical Services – Repairs – New Installation

Electrical Services – Repairs – New Installation

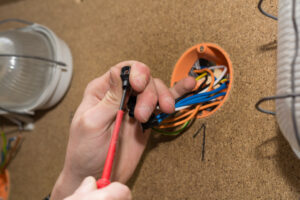

Do you come across frequent electrical issues in your home? Do you feel your electrician is quite expensive? Electricians charge you money even for a minor electrical issue. Most of the electrical issues in your house are minor. You can resolve it on your own if you have proper knowledge about electrical connectivity, diagnosis, and troubleshooting. On the other hand, if you aren’t aware of electrical issues, it is always better to seek the help of an expert electrician. As you read on, you can get to know the most common electrical issues and tips for resolving them on your own, provided you have minimal electrical knowledge.

Blown Fuses: Blown fuse is the most common issue that you might across in your house. A fuse is the thick metal strip in a circuit, which allows the current to pass through it. When too much of the current flows through the fuse, the metal strip starts melting down. As a result, the current turns off. Usually, there are three types of fuses Plug and Type S fuses, cartridge fuses, and time-delay fuses. When you replace the fuse, make sure to replace it with a fuse of the same type and rating. Never use a fuse that has a higher rating than the existing one. Before changing the blown fuse, you need to shut off the main power supply. Then replace the blown fuse with a new one, place it back on the circuit and then switch it on.

Switches: Are you facing issues with certain switches in your house? Electricians can easily resolve an issue related to switches. If the electrician isn’t in your reach, you can replace the switch yourself. Basically there are three types of switches single-pole, a three-way switch, and dimmer switches. Before you purchase a new switch, you need to go through the information printed back of it. Make sure that it is of the same voltage and ampere as that of the previous one back in your home. Before you start any electrical work, always make sure to switch off the main power supply. In addition to that make use of tester in order to make sure that the circuit is dead. Then replace the new switch in the same manner as the previous switch was.

Diagnosing the electrical issue: Your ability to diagnose the issue can be helpful to you and even the electrician to troubleshoot it easily. Over the phone, if you inform the electrician about the actual electrical issue in your home, the electrician can come prepared with the tools and other accessories that are needed.

The most common issues in houses are short circuit, overload, and faulty connections. The overload circuit ends up in a blown fuse. As more numbers of appliances or lamps are turned on, the wiring gets overheated and the fuse blows off. A short circuit happens when the bare hot wire gets in contact in bare grounded or neutral wire. Once you diagnose the issue you can resolve it appropriately. So, even if you aren’t in reach of an electrician, you can resolve a few minor electrical issues on your own. If there is an electrician nearby then you may prefer getting the issue resolved by the electrician.

This Blog was posted for you By Good Electric in San Antonio

- 1

- 2